Achieving Clarity In Customer Data Management Technologies for Insurance

Digital transformation and increasing industry focus on customer experience is driving a renewed interest in customer data management solutions. Customer data platforms and Master data management are two technologies that are subject to a lot of debate and confusion, as they both promise to deliver on the goal of a golden customer record and enabling “360-degree” customer insights.

Master Data Management solutions have been around since the 1990’s and have gradually evolved into robust and proven solutions from leading vendors such as Informatica, Reltio, SAP and Tibco.

Customer data platforms are a more recent breed of solutions emanating from the MarTech (Marketing Technology) industry that are focused on the marketing and sales community.

This article is an extract from an Exavalu whitepaper (available on request) that examines these two technologies and provides recommendations on what is the most appropriate solution depending on your specific use-case.

For example, Customer Call Centers and help desks need to have the entire client profile right in front of them when a customer calls. They should not have to log into multiple systems to service that client.

The 360 view of the customer should provide the authoritative view of that customer and provide all of the information that the call-center specialist requires to not only help resolve the immediate issues of that customer, but also to tailor the customer experience by offering services or additional information to make the customer feel more valued and appreciated.

The challenge of identifying a unique customer

It sounds obvious, but to be able to provide world class customer service and customer experience you must first be able to uniquely identify who your customers are. Are they an existing or past customer or a new prospect? Then you need to understand their full interaction history with your brand.

Finally, advanced analytics and 3rd party data can be used to help identify how best to service and retain that customer, how best to cross-sell to that customer and which new prospects are most likely to buy your products and services going forward.

However, the first stumbling block is just uniquely identifying a customer, and it is not as easy as it sounds. For this, we need to need to be able to match customer data across multiple source systems and decide which customer records relate to the same unique customer, and which pieces of the customer data are the most accurate and up to date. Once we have that, we can then establish a ‘360 degree’ view of that customer so that we can easily see all pertinent information such as their transaction history, active policies, current claims, sales and marketing interactions etc.

Within the financial services industry, especially with legacy insurers the core systems and technologies were designed for transaction level processing, not for managing accounts or books of business. The focus was on registering a submission, issuing a policy, tracking the claims, and generating bills. These ‘core’ processing systems were also not very well integrated, resulting in a great deal of manual ‘rekeying’ of information.

Whenever any kind of cross system information was required, problems arose. For example, it was not a simple process to see all policies and claims relating to a single customer, or even to verify if a claim has an active policy against it. It was very difficult to track the full sales lifecycle from a prospect to a submission to an active customer.

The primary problem was that there was no customer master or customer ‘golden’ record. No single customer id that was being propagated from one system to the next that would enable each system to identify if they were looking at the same customer. No hierarchy information to know if this customer was part of a larger account or grouping such as a household. The same customer could be spelled slightly differently in each system, have different customer ids and even have different addresses. This resulted in incomplete, inconsistent, duplicated, and fragmented customer data across the enterprise.

Over time, these problems have only grown worse in an industry that has struggled to grow organically, and has focused on mergers and acquisitions to fuel top line growth. Each acquisition or merger results in more core systems and books of businesses that must be integrated. Yet more silos of customer data are created that need to be matched, deduped and cleansed.

This legacy customer data challenge is a big one. But the digital age is presenting another set of challenges, involving huge volumes of new customer data from a variety of digital sources including online digital interactions, IOT devices and digital advertising to name a few. All this data also needs to be uniquely identified and matched, often in real or near-real time.

An introduction to Master Data Management (MDM)

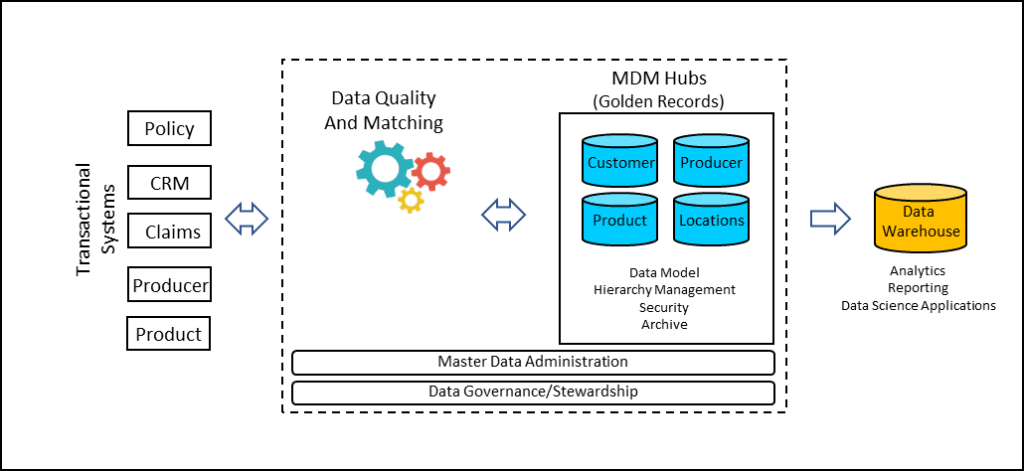

Master Data Management (MDM) was introduced in the late 1990’s as a solution with best in class data matching, identification and cleansing technology that provided a trusted ‘master record’ of critical business dimensions including customer, product, producer and employees.

MDM solutions focus on creating and maintaining a single source of truth, or golden record which is then synchronized and integrated with a wide variety of operational systems throughout the enterprise such as Customer Service and Call Center systems, Billing, Claims etc., to ensure that all systems have the same version of the data.

MDM provides the authoritative foundation for all information across the enterprise and a single source of truth, with the aim of building a “golden record” that has the approved version of the latest and most important data about customers and other business domains.

Fig 1. Simplified MDM System Architecture

Gartner defines MDM as “a technology-enabled discipline in which business and IT (Information Technology) work together to ensure the uniformity, accuracy, stewardship, semantic consistency, and accountability of the enterprise’s official shared master data assets.”

This is in recognition that master data management is not just a technology issue. It requires business leadership, stewardship, and processes to ensure on-going accuracy, reliability and consistency of an organizations master data assets.

Most modern MDM platforms include tools for data governance and stewardship. Stewardship is a set of processes and policies that run on top of the hub. They include data entry (for fixing data into the hub), duplicates handling (for false matches or specific matching cases) and rejects management. Data governance and stewardship teams are responsible for collectively determining the policies, validation, and data-quality rules, as well as service level agreements for creating and managing master data in the enterprise, as well as meeting compliance and regulatory obligations.

Implementation styles for MDM

When MDM is only used for data and reporting purposes it is referred to as Analytical MDM. In this case, it creates master records and master IDs that feed downstream reporting and analytics systems. The master record data is not usually synchronized back to the source operational systems in this model.

Operational MDM refers to when the source systems are also updated or able to access the mastered record. For example, the source system may capture a particular customer on a transaction. After the MDM system has matched and identified the golden customer record, the source system can be updated to reference the corrected ‘golden’ customer record going forward. This is usually the primary use-case for implementing MDM today.

Depending on the scope of the MDM initiative, there are several common MDM implementation styles that support various combinations of operational and analytical MDM use-cases. The most important styles in use today are the Consolidation, Registry, Co-existence, and Centralized Styles. These are explained further in our whitepaper. The newer generation of MDM vendor solutions can support multiple implementation styles at once, depending on your unique circumstances.

The evolution of Customer MDM

Customer Master Data Management began with the goal of integrating silos of customer data across an organization’s IT landscape. The aim was to build a golden record of each unique customer with complete, accurate and current data elements that describes that customer. The technologies involved were heavily based on identity resolutions, data matching / de-duplication capabilities developed primarily for optimizing marketing campaigns.

The technology has evolved and expanded over time and is now uniquely positioned as a key enabler for digital transformation with the ability to provide a comprehensive 360-degree view of customers by combining customer master data with other master data entities, by incorporating data from external sources including real-time digital channels, and including hierarchies, reference data and data insights.

What about Customer Data Platforms?

Traditionally, marketing and sales have relied on their own technology stack for acquiring and tracking customers. This stack is commonly referred to as MarTech. Most notably Customer Relationship Management systems (CRM), Data Management Platforms (DMP) and more recently Customer Data Platforms (CDP).

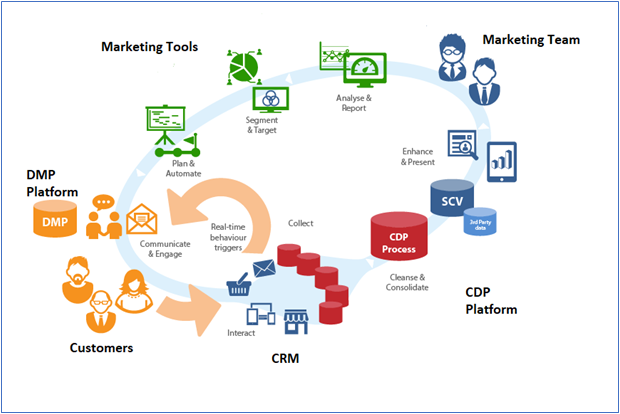

Fig 2. The MarTech Environment

MarTech stands for marketing technology. It is heavily focused on CRM and digital marketing. Since 2011 the market has grown by 5,233% from 150 solutions in 2011 to 8000 today. It represents a $121 billion industry (Chiefmartech.com).

Customer relationship management (CRM) platforms were amongst the earliest MarTech solutions to hit the market. They were introduced to assist sales and marketing professionals to manage their direct interactions with customers. Data management platforms (DMPs) gained popularity in the 2000’s. DMPs are advertiser-focused and primarily used to help inform and feed data driven marketing campaigns. And now, we have customer data platforms.

Gartner defines Customer Data Platforms (CDPs) as “marketing-managed tools designed for the creation, segmentation and activation of customer profiles.”

They were introduced as a reaction to the increased focus on customer experience and omni-channel marketing and the realization that the siloed nature of marketing technologies prevented a 360 view of their customers across all channels.

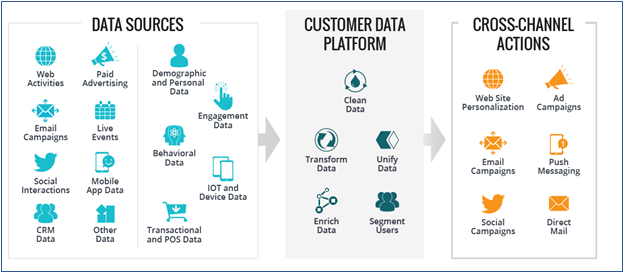

Customer Data Platforms (CDP) build a complete picture of customers on an individual level. They collect customer data (transactional, behavioral, demographic) from a multitude of sources and systems including email, social media, advertising, CRM, instore visits, IOT etc., and link that information to the customer that created it. The data is imported, cleansed, and unified into a 360-degree customer profile, also called a single customer view.

Many CDPs provide a user-friendly interface to group the customers and create a targeted audience segment which can then be used by 3rd party tools or built-in marketing automation tools to execute marketing activities such as personalized web pages, emails, offers and more. Some CDPs provide AI / ML driven segment recommendations such as potential leads, potential conversions, potential product recommendations, etc.,

The beauty of a CDP solution is that it can rapidly empower the marketing team to realize a coherent, trustworthy, and persistent ‘Golden Record’ from many data sources, without needing a team of engineers or IT professionals to manage it.

CDP Vendor Comparison

According to the Customer Data Platform Institute there are at least 133 CDP vendor solutions on the market.

Key features of most CDP solutions include:

- Provide a 360-degree view of the customer

- Gather data from multiple sources into one platform, including first-party, second-party, and third-party data from online and offline sources

- Unify customer profiles across systems

- Support dynamic profile segmentation

- Integration with other marketing systems for targeted marketing campaigns or Ad servers (DSPs) for online advertising

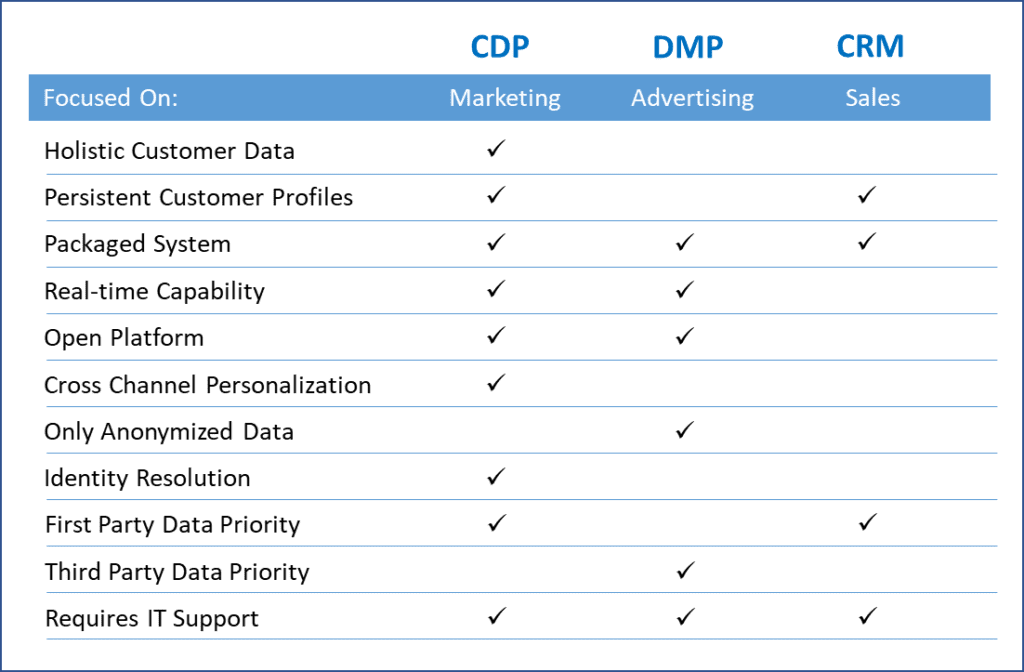

Comparing Master Data Management solutions to Customer Data Platforms

CDPs are packaged software solutions built for business users (mostly marketers), that connect to all customer-related systems. While they do require some technical resources to set up and maintain, they do not require the level of technical skill and overhead of a typical MDM implementation.

A CDP deals with customer data, primarily to support the marketing team. As with an MDM solution, it collects, cleanses, de-duplicates customer information and will create a singular customer record along with information of all customer interactions with your brand across all marketing channels. It is designed for management of marketing campaigns through segmentation and data analysis, campaign automation and customer journey management and integration with email platforms, online advertising solutions and real-time personalization tools.

CDP’s are quick to implement and can create a single customer record and a Customer 360 view from internal customer systems as well as digital sources. They are designed on modern cloud based digital platforms and can ingest large volumes of data required for modern digital marketing and customer experience.

It is difficult to directly compare CDP’s to MDM, since MDM has a much wider scope.

MDM is truly an enterprise enabling technology focused on creating and managing a ‘single source of truth’ for multiple business master domains including customer. MDM is not only for analytical uses but also intended for operational use with 2-way synchronization with other systems so that mastered data can be propagated to other transactional systems throughout the organization, so that the whole organization has a single view of the truth. In addition, MDM is founded on core data management principles of metadata management, data standards, data quality management and data governance.

All of this has traditionally made MDM complicated and expensive to implement, however with newer 3rd generation MDM solutions the barrier to entry has been lowered with the introduction of subscription-based pricing and simpler entry-level and cloud based solutions allowing a viable “start small and grow” approach.

The Bottomline

Ultimately, it appears that both CDPs and MDM have their own place in the solution landscape of a modern digital organization. Despite confusing marketing and sales literature about CDP’s as the enterprise solution for customer experience and customer management, they are in fact focused on marketing only. What a CDP does really well is gather to a lot of customer data from various sources, correlate it and segment it for marketing purposes. They are designed for easier integration with downstream advertising and marketing systems. MDM focuses on more than just customer data and is a true enterprise solution designed for integration with operational and analytical systems throughout the organization.

The risk for organizations that already have MDM or are trying to implement MDM, is that the CDP may introduce yet another data silo or alternative single customer view.

Forward thinking MDM vendors such as Reltio, who are expanding their cloud-native offerings to include digital data streams and extended customer 360 views are building and promoting capabilities to integrate with CDP’s so that the MDM platform is used to supply clean, accurate and up-to-date master customer data to the CDP. The CDP then focuses on segmentation and direct marketing. This appears to offer a best of breed of approach, where the same golden master record is shared throughout the organization including the CDP, and the CDP can still be used as a powerful marketing tool for customer experience analytics, segmentation, managing marketing campaigns and digital advertising.

Which technology you finally select will be driven by your use-case and desired outcome. Exavalu is uniquely qualified to help you navigate the MDM and customer data management landscape and quickly unlock value.

Exavalu as your Customer Data Management Partner

Exavalu is a unique Business Advisory and Technology Consulting firm run by seasoned industry veterans consisting of former executives, CIOs, CXOs, and Consulting Principals focusing on digital transformation strategy and solutions.

Our Customer Data Management services include:

1. Customer Data Strategy and Roadmap

We help our clients define an integrated and holistic customer data strategy that incorporates your digital transformation and customer experience objectives as well defining the future state technical architecture, and core data management tools and capabilities needed for success. For example, in one of our engagements for a large personal lines insurance carrier we defined not only the end-state architecture for MDM and customer 360, but also the data governance structure required to ensure the long-term success of the initiative.

In mapping out the roadmap for implementation of your customer strategy implementation, we ensure that there is strong interlock with other digital transformation streams and a focus on early business value capture. Our approach can best be described as one that incorporates short-term quick hits to address ‘low hanging fruit’ opportunities while also building out the necessary architecture, tools and capabilities to address long term goals.

2. Vendor Selection and Evaluation

Using our structured assessment and evaluation process we have assisted several clients in selecting the most appropriate MDM or customer data management tool for their needs. Our process begins with clarifying the strategic objectives of your customer data initiative and then defining the primary business use-cases that support it. Then we help you to define the technical and functional requirements for your solution needs, and important vendor assessment criteria. From our knowledge of the solution marketplace, we can help to create a short-list of suitable vendor solutions for evaluation. Our end-to-end process includes:

- Requirements Definition

- Creation of RFI and RFP documents

- Vendor Selection Scorecard and evaluation criteria

- Vendor POCs and bake-offs

- Vendor Recommendation

- Solution Architecture and Implementation Roadmap