Exavalu LMS: Digital Sales Transformation to Power Your Lead Management Processes

In the Insurance industry, sales organizations rely on various marketing & advertising campaigns, which if successful, generate high volumes of leads that need to be tracked and followed up with if the campaign is to be deemed successful. In some companies though, this high volume can overwhelm the sales organization because they are simply not able to efficiently handle the influx over a short period of time and many leads are never followed up with.

The result could be that while Insurers are trying to grow their business through sales of various policy products, their current processes for handling and managing leads may be inhibiting your growth or possibly working against it and it may be time to consider a Sales Automation solution.

The primary goal of a Sales Automation solution is to improve an organization’s top line by helping its sales teams generate more revenue through three key mechanisms:

a) smarter lead management,

b) faster sales velocity, and

c) increased deal size.

Exavalu has created a Lead Management Solution (LMS) built on top of the Pegasystems Sales Automation for Insurance foundation. Our Lead Management Solution applies intelligent automation (historical analysis and predictive modeling) to your incoming leads, yielding better quality leads, which turn into greater numbers of new policies sold, in shorter periods of time. which analyzes historical and predictive factors to help organizations manage leads more efficiently and profitably.

By automating the analysis of factors like geographic location, historical sales rep performance, and dynamic lead scoring, our Lead Management Solution allows companies to deliver qualified leads to the individuals most likely to convert them into sales. In a nutshell, Exavalu’s Lead and Opportunity Management Solution empowers your company to leverage the best features of automation – efficient and accurate data processing – as a tool to help your team streamline their workflow and convert more sales.

Sales Automation Process Overview

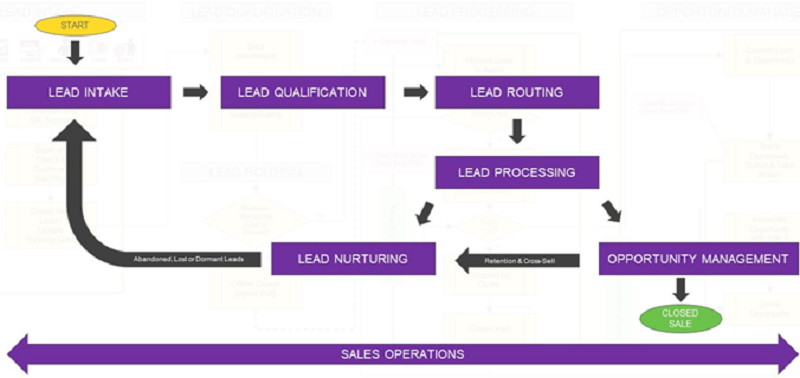

A high-level overview of the Lead and Opportunity Management Solution shows the functional stages comprising the overall solution:

A closer look at the activities within each stage are described as follows:

Lead Intake: Leads come from numerous sources and can be broken into two basic categories: offline leads (web forms or email campaigns); and live leads, (phone calls or chat requests). Regardless of where the lead originates, the Lead Intake stage follows the same process:

1) Aggregate leads across different channels;

2) Perform lead matching and de-duplication processing; and

3) Create a new lead or update a lead that is currently in the system.

Lead Qualification:

Lead data gets enriched and then the lead gets scored relative to other leads in the system. The lead score, enables the system to prioritize which leads move up and down in the work list.

Lead Routing:

After qualification, the system routes the lead to an agent. For offline leads, the routing engine will send it to a work queue for retrieval by an agent determined to be best suited for the lead. Factors influencing this determination include attributes of the lead and attributes of the agent.

If the lead is live (e.g., a phone call or chat request), the routing engine looks to see which agents are currently available. The system then routes the call or chat to the best available agent based on the factors described above. If no agents are available, the lead will be placed in queue and passed on to the next available agent.

Lead Processing:

This stage presents the lead to the agent, who begins working the lead in order to determine whether the lead should convert to an opportunity or be closed and moved to a Lead Nurturing stage. Off-line leads may require multiple attempts for the agent to establish contact with the lead and the solution tracks this activity. For a live leads, the agent immediately interacts with the lead, gathering additional information about their needs and preferences, and should be able to make a quick determination about converting to an opportunity or closing it out.

Opportunity Management:

At some point while the agent is working the lead, a decision is made whether or not to convert the lead into an opportunity. Once in the Opportunity Management stage the solution tracks the opportunity through a completed sale or closing it out.

Lead Nurturing:

Closed leads and lost opportunities are passed to a Lead Nurturing process. At some point in the future, the Lead Nurturing process will create a new lead (based on the response from one of its nurturing campaigns) and pass it back to the Lead Intake stage.

Key Features and Functions

While the Pega OOTB (Out of the Box) implementation for Sales Automation has many configurable capabilities, Exavalu has created a set of accelerators for the SA platform to improve the overall functionality and value of the Sales Automation solution. The table below provides a summary of these added accelerators:

COMPONENTS |

PEGA OOTB + EXTENSIONS |

EXAVALU ACCELERATORS |

| Lead Intake |

|

|

| Data Profiling &; Policy Match |

|

|

| Qualification & Scoring |

|

|

| Agent Matching & Routing |

|

|

Beyond Sales Automation

Exavalu’s Lead and Opportunity Management Solution is one of several core Insurance Industry solutions available for the Pega Platform. Drawing on our collective decades of Insurance Industry experience, Exavalu also designs solutions for Customer Service, Claims & FNOL, Underwriting Desktops, and more. We customize and optimize these solutions to meet any insurer’s business needs and help them along their digital transformation journey.

In Conclusion

Sales organizations are under constant pressure to grow their company’s revenues through sales of new policy products and services. With Exavalu’s Lead Management Solution, you can measurably improve the means by which you manage your sales process applying intelligent automation to your incoming leads across all your marketing channels, resulting in better quality leads, which will turn into greater numbers of new policies and services sold, in shorter periods of time.

About the Author:

Lee Tucker is a Business Architect with Exavalu’s Insurance Advisory Practice. He has over 30 years of experience focused on Self-Service, CRM and Contact Center automation solutions across multiple vertical industries such as Insurance, Financial Services, Healthcare, Travel and Hospitality. You can reach him at Lee.Tucker@Exavalu.com.

Exavalu is a Business Advisory & Technology Consulting firm that delivers high-impact digital solutions, tailored to your industry and company needs. Our team comprises seasoned industry veterans, including former executives, CIOs, CXOs, and Consulting Principals. We leverage our cross-industry expertise and shared solutions focus to deliver meaningful change and sustained value that aligns with your desired business outcomes.

This publication contains general information only and Exavalu is not, by means of this publication, rendering accounting, business, financial, investment, legal, tax, or other professional advice or services. This publication is not a substitute for such professional advice or services, nor should it be used as a basis for any decision or action that may affect your business. Before making any decision or taking any action that may affect your business, you should consult a qualified professional advisor. Exavalu shall not be responsible for any loss sustained by any person who relies on this publication.