Turning Data Into Capital: Impact Of Modern Data Platform on The Insurance Industry

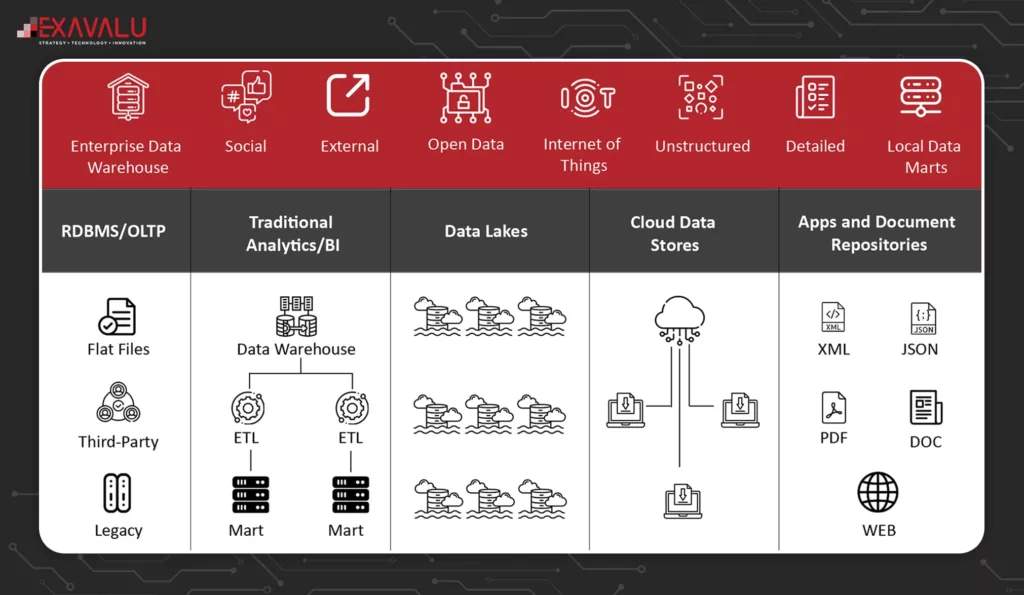

The insurance industry is facing rapid changes in broker relationships, customer demands, market conditions, and organizational structures. These changes have made it difficult for existing data warehouses and the teams responsible for them to keep up with the changes to the data sources and new data sets collected from newly implemented systems, mergers, and acquisitions. The challenge is to address this evolution while also meeting the changing analytical needs of the enterprise and maintaining the business status quo. This challenge has led to the industry-wide realization that traditional data warehouses are no longer sufficient to meet the needs of the users. To meet current and future business requirements, insurers are looking for more agile ways to access internal and external information.

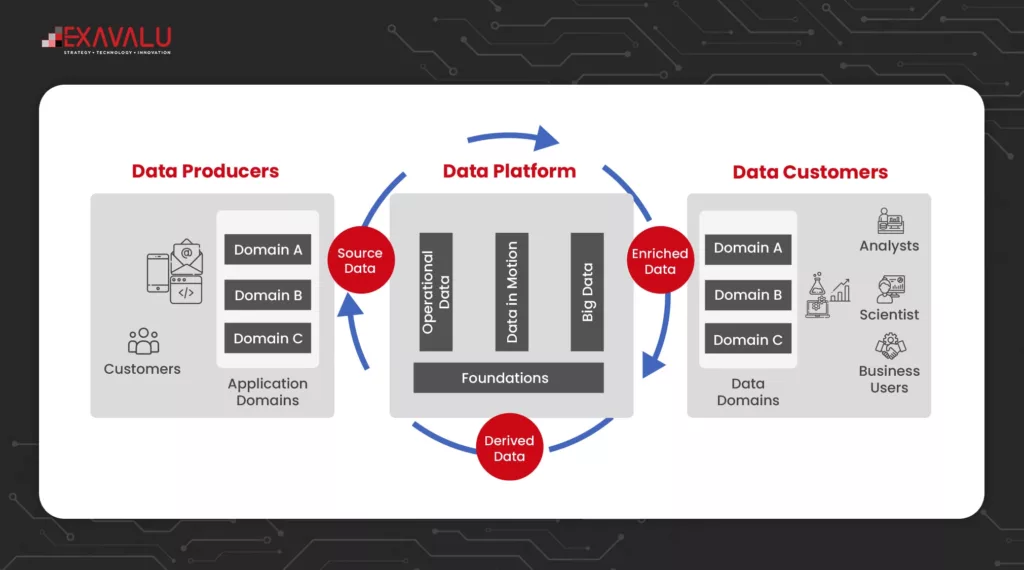

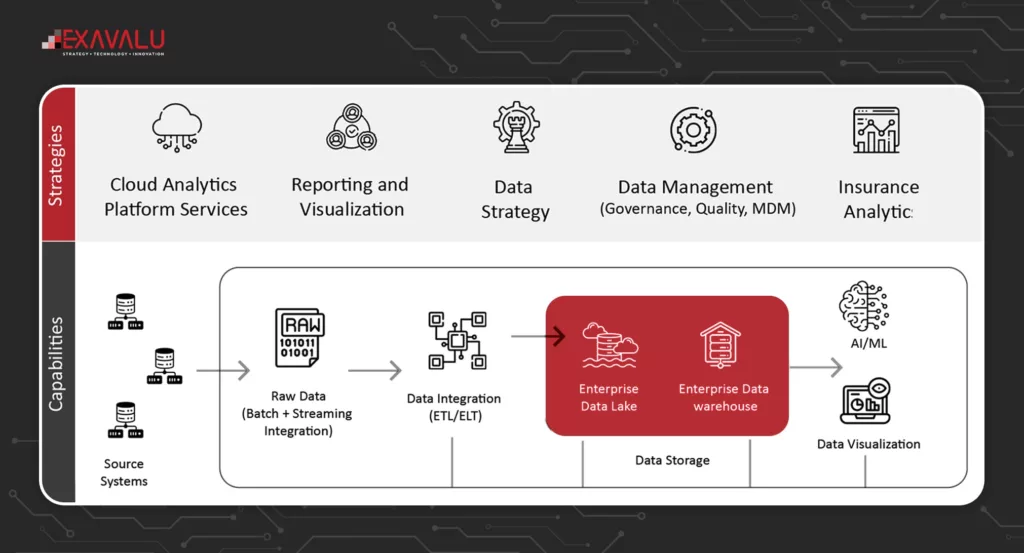

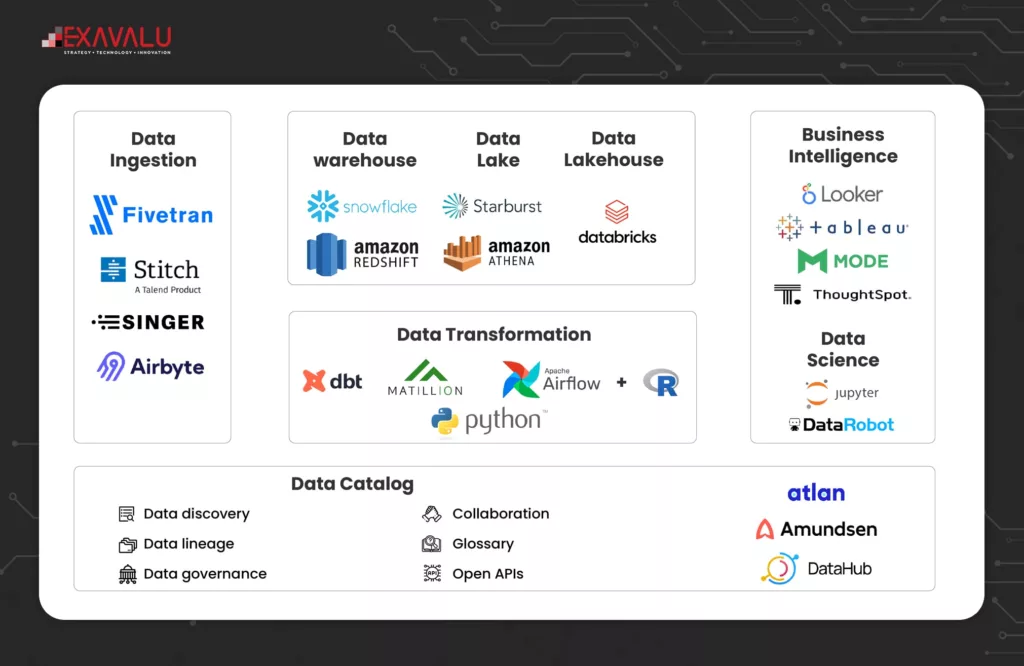

By adopting a modern data platform and strategies., Insurers can transform all data-related processes and tear down the siloed data sources to enrich and democratize their analytics capabilities. To overcome data processing obstacles, insurance companies need to fundamentally reevaluate their data and analytics strategies and implement modern technological foundations like-

- Cloud Technology allows access to powerful tools and resources for storing, processing, and analyzing large amounts of data and ensures the protection of sensitive information,

- Cloud-based Data Lakes for real-time processing and analyzing complex data sets,

- Artificial Intelligence and Machine Learning Models on the cloud that improves straight-through processing and improve product development and predictions, and lastly,

- Strong Data Governance Protocols to improve data quality and implement data protection and security solutions that improve compliance and security.

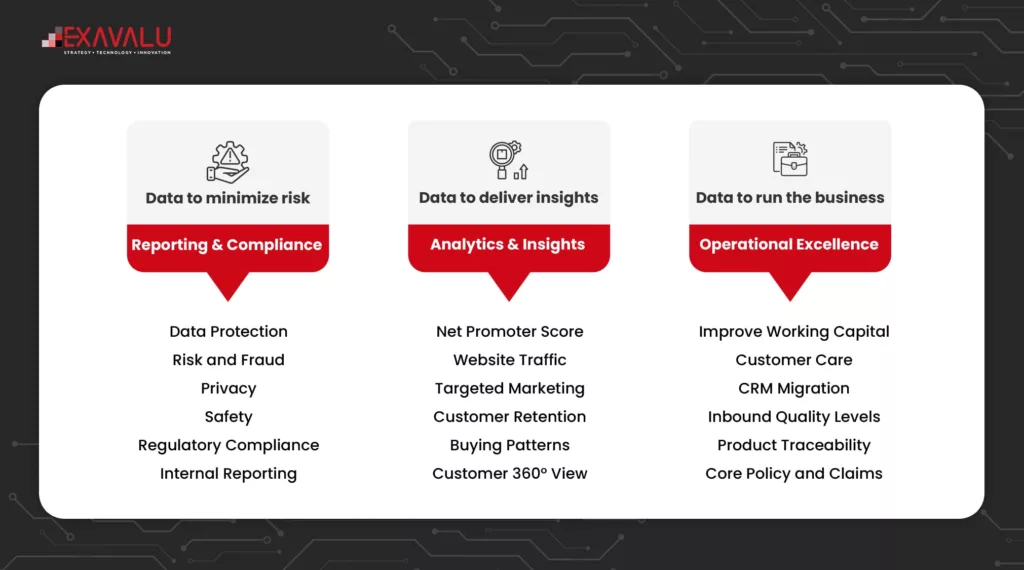

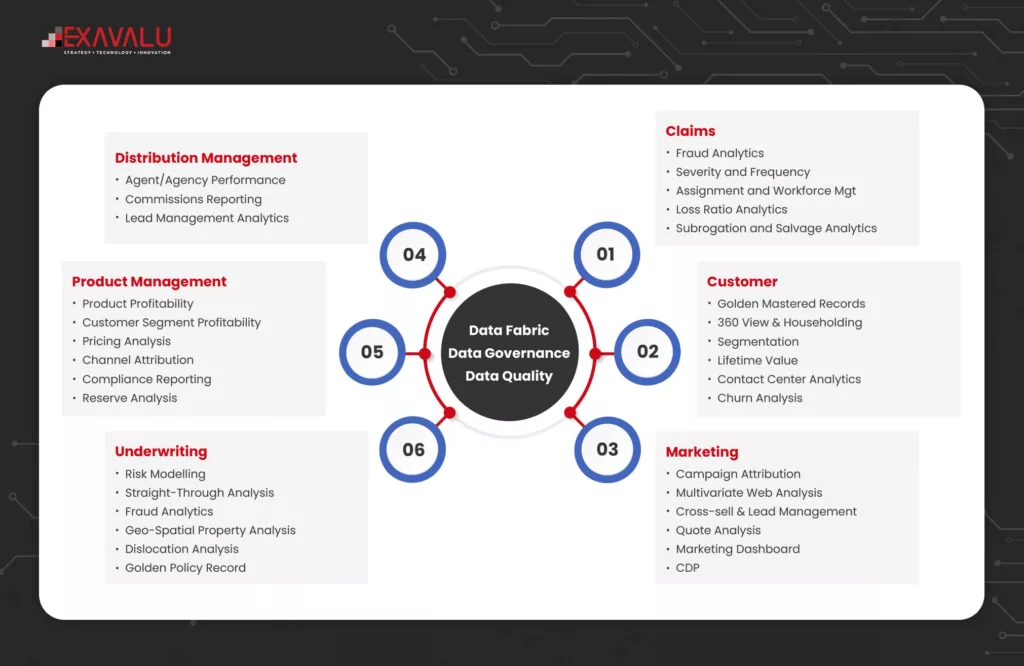

Implementing modern technological foundations in support of data management practices will help insurance carriers to transform every aspect of business operations as illustrated below-

Over the years, Exavalu has worked extensively with leading insurance industry clients, which has given us ample expertise and experience. Based on these, we have formulated a set of fundamental concepts and essential principles insurers can use to elevate their data operations and drive better growth for their business.

Now let us take a detailed look at why traditional data warehouses are failing.

Traditional Data Warehouses: Why Are They Failing?

There are five key challenges inherent in traditional data warehousing: an inflexible and complex structure, slow performance, lack of elastic capacity, outdated technology, and a lack of modern data governance.

Inability To Adapt To Changing Needs

The rigidity of Traditional Data Warehouses (TDWs) often prompts organizations to acquire additional hardware and tools to meet their data requirements promptly. This patchwork of hardware, tools, and software results in a complex and redundant architecture with multiple data siloes, unable to adapt to the changing needs of the carriers.

High Costs And Failure Rates

TDWs are infamous for their high failure rates, with some reports indicating and failure rate of over 50% according to Tim Mitchell, a data architect. These failures are not solely due to technical challenges or complex architecture but also stem from a failure to meet user requirements and needs.

Inefficiency And Slow Processing

The amount of data that businesses need to store, process, and analyze has grown dramatically in recent years. This increase in volume can have a significant impact on the performance of TDWs, resulting in slow performance and delays in reporting.

Obsolete Technologies

Traditional TDWs are far behind modern technology, as they were set up years ago, therefore unable to deliver capabilities around scalability, and enhanced storage.

Insufficient Governance And Control

TDWs present significant governance and control-related issues that prevent insurance organizations from implementing an IT structure that can quickly adapt to meet the changing demands of the customers.

Importance of Adaptation

Many IT and insurance analysts and industry experts believe that data warehousing is an essential component of modern business. However, the traditional solutions are no longer adequate. The emerging data sources, trends, and technologies are challenging the effectiveness of data warehouses for supporting analysis and decision-making. However, IDC states that Data Warehouses are not going away and still have a key role in an organization’s data architecture, making adaptation crucial.

Not adapting to these changes can be costly for insurers. For example, without integrated data and advanced analytics capabilities, Insurers will miss opportunities to improve their competitive advantage or eliminate risks, lack relevant insights, and weaken their brand. This will lead to losing customers and ultimately, lost revenue and the collapse of the company. The solution to these challenges is a modern data platform.

Modern Data Platforms are needed to enhance Analytics Strategies

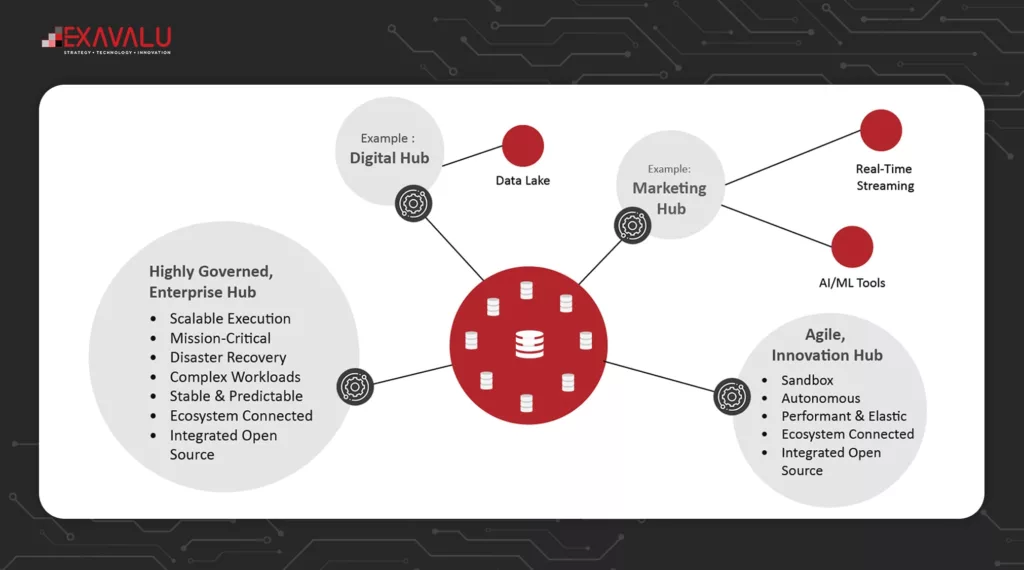

Insurers of all sizes need a data platform that allows them to adapt to changing business needs and manage the growing amount of data. Today the Insurers need to have self-service for Diverse Users along with Agile Data management.

The platform must be flexible and responsive, with standardized processes and a single source of truth to support predictive and prescriptive analytics. It should use modern cloud data management software and high-performance and elastic hardware. Specifically, insurers require a data pipeline that can capture and store large amounts of data from various internal and external sources, including social media and text logs. They need the ability to process data in memory for quick reporting and real-time insights. Tiered storage for easy access to data when needed, such as for financial audits. Compatibility with all business intelligence processes for easy access by business users, and advanced analytics capabilities for deeper claims insights, connected opportunities, and improved pricing and risk management.

Insurers need a data platform that can adapt to changing business needs and handle the growing amount of data. These platforms offer advanced database and data management technologies, analytical intelligence capabilities, and intuitive application development tools on a single, unified in-memory platform. Such a platform facilitates high-performance advanced analytics that can access data stored within Hadoop. Modern platforms provide enhanced high availability, security, workload management, enterprise modeling, data integration, and data quality. Additionally, these platforms enable logical data warehousing, which reduces the need for ETL and aggregated data and can store and analyze data regardless of its source, form, or structure.

This shift away from traditional ETL to the extract, load, transform paradigm (ELT) allows faster loading time. The platform also enables smart data access, making it easier to organize and display unstructured data as if it were structured. Modern analytics platforms provide high performance through in-memory processing, accelerating the speed of data preparation and consumption processes, and reducing disk bottlenecks. The virtual models in the platform allow for in-situ analysis, reducing the need to move data around and eliminating tasks such as aggregation and duplication. Its compatibility with powerful integration tools enables faster data delivery and loading.

This is future-proof technology that can meet the demands of modern insurers through big data and IoT. It has been designed specifically to overcome these challenges and drive performance. The platform can be hosted in the cloud, allowing for a “pay-as-you-grow” basis and supporting new insurance product/business development, which reduces capital expenditure and financial risk. It also supports a tiered data architecture that can help organizations avoid archiving potentially useful data. Additionally, it provides full control and governance through comprehensive security and auditing functions, enabling multitenancy solutions for controlled access to data and reducing potential issues arising from mistakes and complications. The platform also delivers data quality, and visibility into data lineage, and presents it on a graphical user interface.

Principles for moving forward

- Design for scalability and flexibility– the architecture should enable on-demand computation performance, allow the business to access and utilize data independently of IT, and utilize cloud technology to enable the organization to easily scale up or down as computing needs change.

- Make metadata a priority from the beginning– leveraging metadata, and information about the data they hold can provide insurers with deeper insights and context. However, metadata extraction often becomes an afterthought, driven by compliance requirements. Managing metadata early is much easier, and its value can extend far beyond compliance. With cataloged metadata companies can create a library of data sets that can be accessed by everyone in the organization, thus enabling wider use of insights generation and AI throughout the enterprise.

- Implement a unified security model for data– companies often use complex hybrid environments that blend cloud-based and on-premises services, with data stored in various locations and accessed by various individuals and systems. A unified security approach allows companies to consider security from the point of data creation to all points of consumption and during all stages of data enrichment.

Conclusion

Many insurance companies have implemented data warehouses and analytical applications, but they often fall short of meeting the demands of a rapidly changing business environment. This is primarily due to inflexible structure, complex architecture, slow performance, outdated technology, and lack of governance. These issues impede an insurer’s access to reliable data and their ability to make well-informed, forward-looking decisions. Without this, insurers risk losing customers in soft and emerging markets and miss opportunities for enabling their human capital’s ability to utilize data and analytics to improve decisions and processes. A modern data platform can help insurers overcome these challenges, allowing for new products and services to be developed without disrupting the existing IT landscape.

With a more flexible structure and compatibility with leading-edge technology, the modern data platform is equipped to handle today’s constantly changing data requirements. Its simplified architecture streamlines the process from data capture to actionable insight, reducing decision lag. Furthermore, it delivers these benefits without compromising on governance requirements and can serve as the foundation of a data governance strategy that can be extended throughout the enterprise.

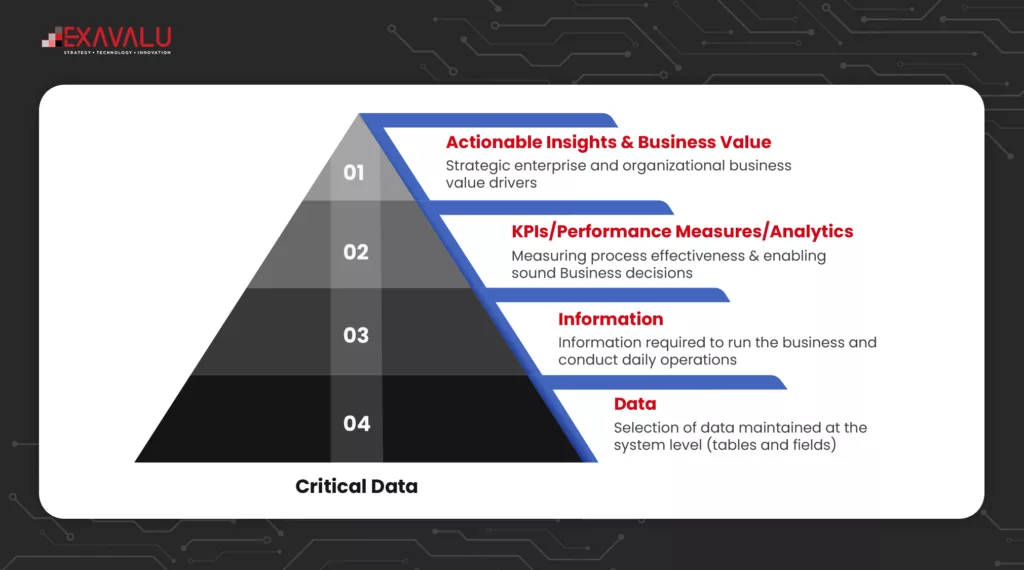

To turn data into capital, insurers must identify mission critical priorities and critical success factors and map their business initiatives to specific outcomes with quantifiable impact. The strategies must fundamentally address the needs of the business across all areas:

Strategies such as mastering data about customers, agents, assets and claims data can promote significant upside with cross sell opportunities and improved customer experience. Data driven enterprises embed data in every decision, interaction and process in real time. Treating Data as a product and utilizing ready- to-use-data while preserving data quality, privacy and security requires a data driven culture that is supported by modern data fabric.

About the Author

Rahul Chakladar is a Consulting Manager with Exavalu Data and Analytics Practice. He has more than 16 years of experience in Management and Strategy consulting. He has worked extensively worked across industries such as Insurance, Banking, Retail and Consumer Packaged goods. You can reach him at Rahul.Chakladar@exavalu.com