Expand Insurance Automation Abilities with Brand New Salesforce Winter’22 Flow Updates!

The new Salesforce winter release has introduced many new features including major enhancements in process automation. Our thought leaders of Salesforce Insurance industry have examined some of the most promising feature updates for Salesforce to understand how they would solve the existing & troublesome use cases in the insurance industry

Amongst many feature updates happening in this release, Salesforce Flow is getting one of the biggest upgrades since 2019. The Salesforce release notes reveal a number of major changes to the existing Flow features, as well as some new features that are meant to reduce the complexity of business automation process for multiple industries.

In this digital-driven insurance industry environment, Salesforce Flow happens to be one of the biggest accelerators of business automation and will have a significant impact on the modern Insurance industry. So let us examine the top 5 winter’22 Flow features and how these new Salesforce features are going to transform the problematic use cases for insurance business processes. Most of these new features will benefit multiple industries and hence business across industries should seriously consider leveraging these to reap the full benefit of Salesforce platform.

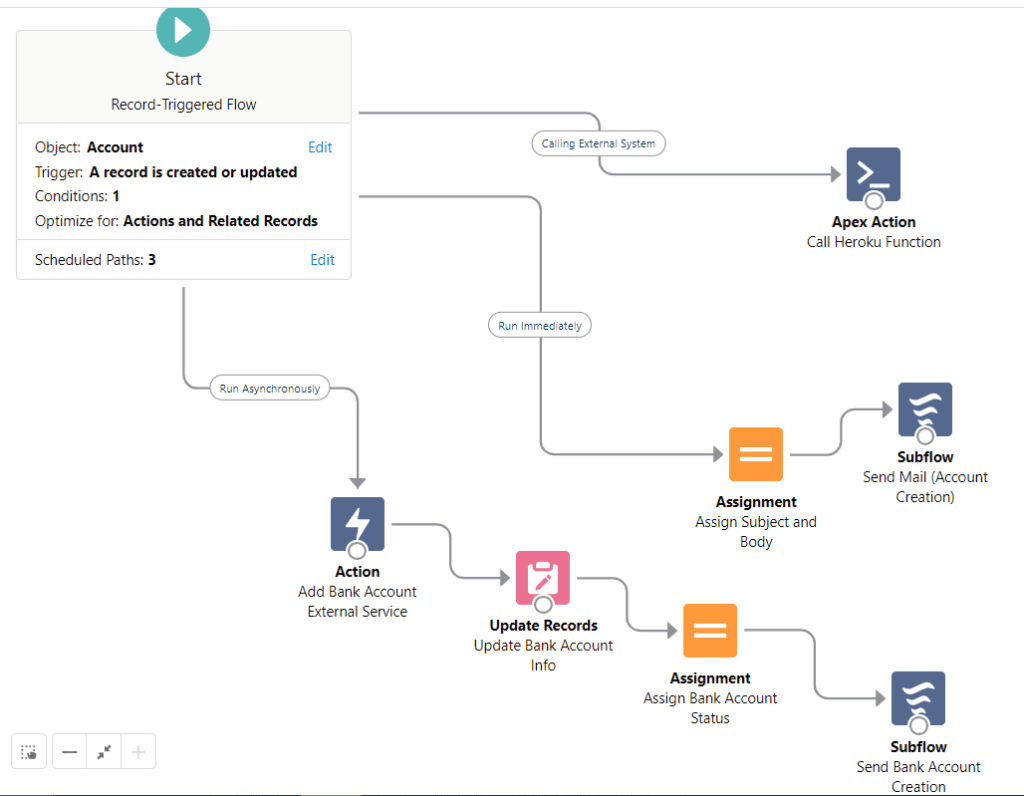

Feature 1: Connect a Record-Triggered Flow to an External System Using an Asynchronous Path

Previously, for record-triggered flows, only scheduled paths were available.

With the new Salesforce winter release, the record-triggered flows can perform actions beyond the limitations of transaction boundaries. It can also be integrated with external systems and update external objects.

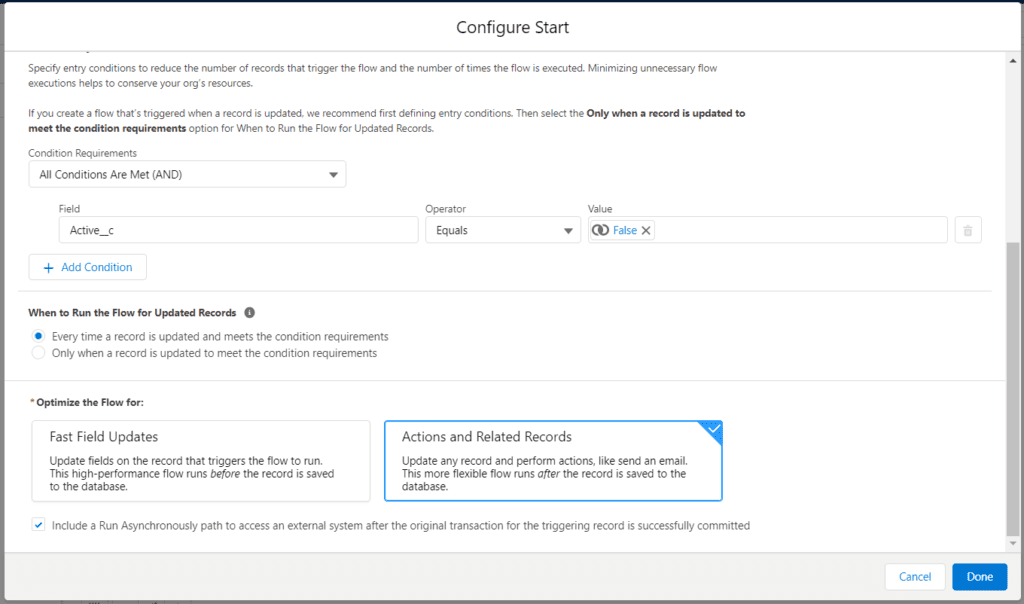

To make this happen, developers need to add an Asynchronous Path to the flow and configure the flow to run only when a record is updated to meet the condition requirements. Selecting “Include a Run Asynchronously path to access an external system after the original transaction for the triggering record is successfully committed” will queue an Asynchronous Path for the flow to run when triggered by a new or updated record. The Asynchronous Path can be monitored on the time-based workflow page in Setup.

Use Case:

Let us consider a scenario where an Insurance Agent needs to capture Driver and Vehicle Information from a Customer and provide them with a quote. The quote is calculated by a policy admin system that can be accessed via exposed external services.

Here’s what’s happening-

| Previously, an after updated trigger calling a future method for the callout would be needed for the above use case. | Now, with Winter’22 release, you can add an Asynchronous path with a record triggered flow to call the external system to send the Information to the External service and get the quote information back to the system. Click here to know more >>> |

Feature 2: Create a Managed-Installed Flow That Admins Can Override and Customize

Before the update,if an admin wanted to make changes to a Managed-Installed flow, they would have to create a new, editable flow from the template, and then manually optimize the reference to the flow such as processes, REST API calls or custom buttons or links to complete customization. This proved to be a time-consuming and complex task.

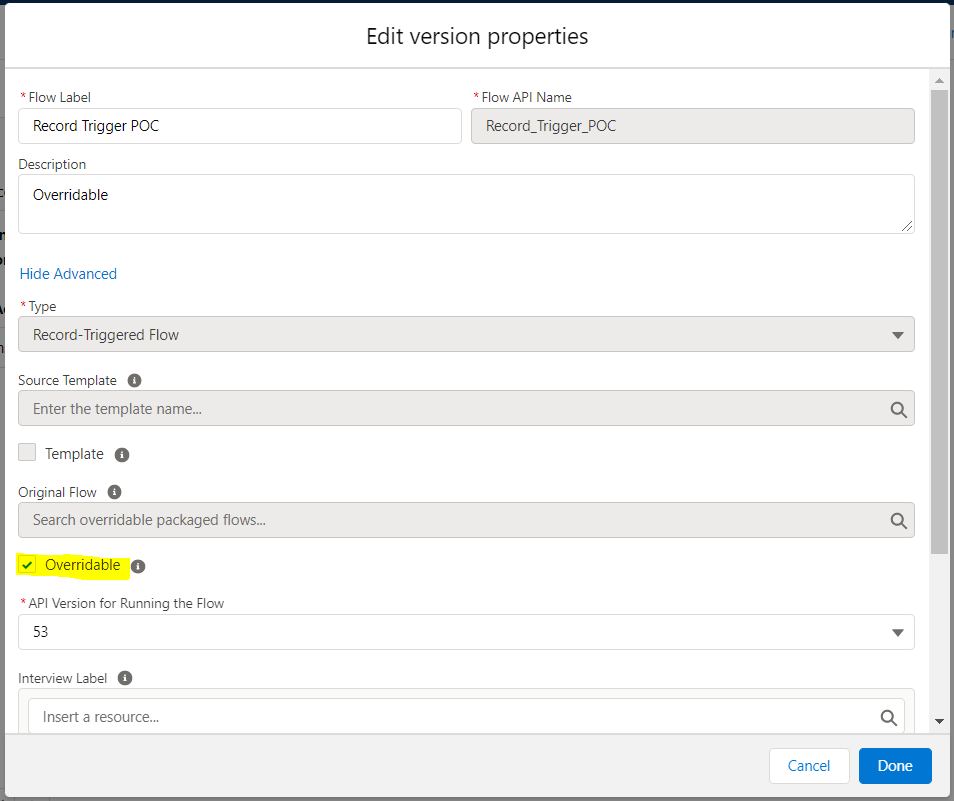

Now, the developer can create a flow that admins can override and customize parts of an application. Once the admin creates and activates the flow override, any request will then execute the override, not the original flow. This reduces the number of time Admins need to spend updating any references of the original flow.

Use Case:

Let us consider a scenario where a specialized manage package has been installed by an organization for Insurance Claim Processing. This package contains a combination of objects, flows, etc. Admin needs to modify the input fields and validations on the Driver and Vehicle screens of Quote Request screen flow which is embedded on the home screen.

Here’s what’s happening-

| Previously, admin had to create a new flow, the same as the previous one, and then incorporate the changes needed. Finally, they needed to remove reference to the original flow to the new one, in this case, the home page layout. | Now with Winter’22 Salesforce features, the flow can be marked as overridable within the managed package by the flow developer. In that case, admin can create the flow with the changes and indicate that it overrides the original flow. Once the override is active, the modified flow will be visible on the home page. Click here to know more >>> |

Feature 3: Roll back pending Record Changes When a Flow Element Failed at Run Time

Earlier, when a Flow contained multiple sequential DML Elements with Fault Handling, having atomic control [‘all or none’ database commit] was not possible. As a result, failure of one of the elements would not prompt the rollback of the entire transaction.

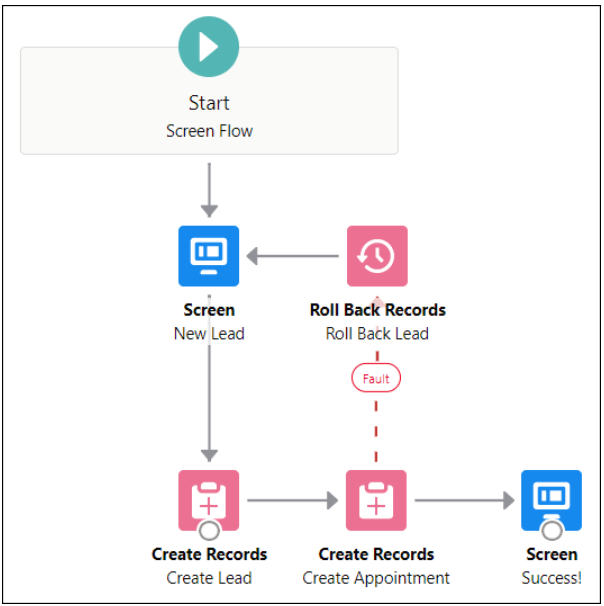

Now, with the ‘Roll Back Records’ element developers can roll back a transaction and cancel all its pending record changes in between two screen elements in flow when one of the DML elements fails. The Roll Back Records element needs to be placed in the fault path of the element that failed. This element is also applicable to rollback pending changes based on business logic, in which case it needs to be placed in a Decision element’s outcome.

Use Case:

Let us consider a scenario in a Group Insurance Organization, where the Employer Organization (Account) Shipping address is kept in sync with Employer Contact’s Mailing Address so that employer contact can receive Explanation of Benefits for review at the same business address.

To implement this, a developer creates a Salesforce Flow to update the Organization Account Shipping address which also updates the Mailing Address on all related contacts. The developer also creates a fault connector to capture failures and display an error accordingly in case any element fails.

Here’s what’s happening-

| Previously, with the fault connector in place, if the Organization update succeeds but the contact update fails, then the Organization address will be out of sync from the contact. In order to keep them in sync, the fault connectors would need to be removed which would cause unhandled exceptions to be displayed to business users. | Now with the new Roll Back Records element from Salesforce winter ’22 release features, you can gracefully handle the flow exceptions and choose to either roll back the entire transaction or do a partial commit. Click here to know more >>> |

Feature 4: Enhancements for Scheduled Paths with Minutes, Limits & Batching!

Earlier, users could only specify the number of hours or days before or after the time source for a scheduled path to run.

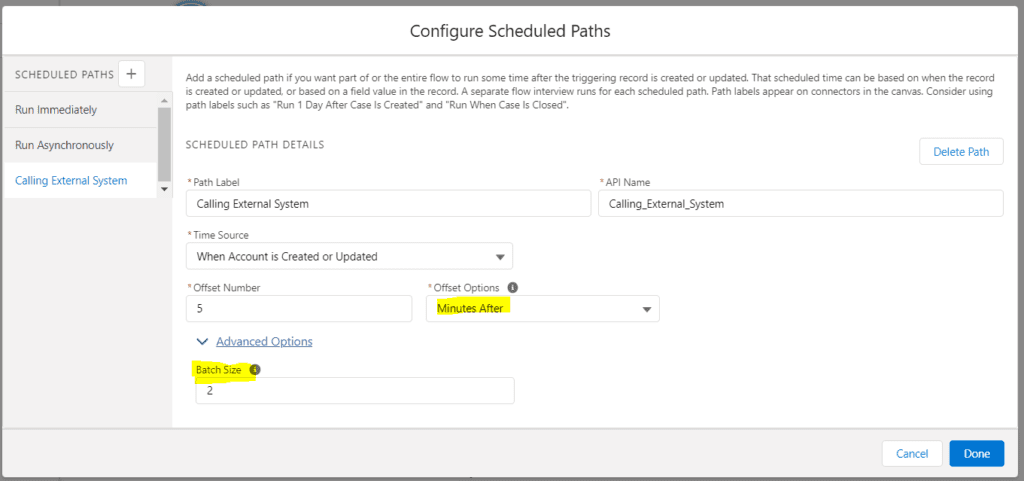

Now, users can specify the time of the scheduled path to run, down to the minutes. Applicable on Lightning Experience & Salesforce classic editions, this update allows the users to set batch sizes to process limited numbers of records at a time. This enhances the system performance and reduces the chances of clashing with the Apex Governor limits. With this update, the complex operation of business process automation becomes easier.

Use Case:

Let us consider a scenario where approved insurance payments need to be submitted to a processing system for Disbursement and Accounting. End-User has the option to approve multiple payments at the same time.

However, the payment processing system has an Exposed External Service that can accept one payee information at a time for disbursing payments.

Here’s what’s happening-

| Previously, processing the callouts with a batch class or chaining a series of the queueable apex was the best bet. | Now with Winter’22, Schedules Paths of Record-Triggered Flows are getting supercharged with a minute-based time offset and batch sizes. This can be used to call the External Service with a small batch size (1). This will allow for processing of the entered Account, one at a time. Click here to know more >>> |

Feature 5: Call another Flow from a Record-Triggered Flow Using a ‘Subflow’ Element

Prior to the new update, subflow elements were not available for record-triggered flows, resulting in automation slowdown, as several reusable functionalities had to be re-written manually.

The recent update makes it possible to record trigger a sub-flow element to run after a record is saved or a record is deleted. With this feature, developers can reduce the complexity of a flow by breaking down the automation into building blocks. Simultaneously, developers can also call a reusable flow to perform repetitive tasks without the need to write it manually.

Use Case:

Let us consider a scenario where an Insurance Claim Processing system needs to initiate Document verification Requests for different Business Processes like Quote Preparation, Claim Intake, etc. Some of the activities for Document verification are common, like reviewer determination based on policy type and assigning a task to them with the details.

Here’s what’s happening-

| Previously, the business flow for assigning the document verification request and notification for the same needed to be implemented separately for each of the processes. | Now with Salesforce Winter’22 release notes, reviewer determination and notification can be housed in its own flow component and can be called from both the Quote Processing and Claim Intake flows to get the document verification request routed Click here to know more >>> |

How Exavalu Can Help Leverage Benefits of Salesforce Winter’22 Updates?

Exavalu has a team of Salesforce experts with extensive experience in financial services industries implementing Salesforce across multiple clouds(Sales, Service, Marketing, Financial Services, Vlocity) integrated with the Mulesoft platform.

As a Strategic Partner of Salesforce, we enable faster adoption of insurance industry-specific solutions for our clients leveraging Salesforce out-of-the-box features reducing development risks & complexities leading to complete automation of the business processes. Exavalu’s implementation methodology follows thoughtful declarative over custom development. The Winter 22 features will further enhance declarative development and will cut down the Apex coding development time and will reduce effort & cost, helping better ROI. Exavalu can assist Business and IT with easy adoption and upgradation efforts leveraging low-code no-code capabilities of Salesforce platforms.

About the authors:

Snehashis Ghosh is a Certified Salesforce Architect and speaker in Dreamforce with 17+ years of IT industry experienced in Consulting and delivering enterprise-scale business and technology transformation, system integrations, performance engineering, DevOps implementations in Financial Services, Insurance, Life Sciences, Media Entertainment, Retail, and Healthcare industries. As a seasoned change management advisor, he provides clients a thorough change management plan which helps an enterprise to optimize feature enablement strategy, IT spending, and preparedness for change impact.

Souvik Mukherjee is a Certified Salesforce Tech Lead with 15+ years of IT industry experienced involving technical solution design, consulting, delivery management, customer management, offshore coordination, and implementation of large-scale projects for industry leaders in Insurance, Real Estate & Supply Chain business domains.