How Insurers Can Leverage Digital Payments To Reinvent Insurance Payment

Financial transactions are at the core of the Insurance Industry. Whether it is customers paying premiums or insurance carriers disbursing claims or refunds- a certain ease of operations is expected by everyone involved in the process. However, the legacy insurance payment processing systems used by traditional insurance carriers cannot offer the expected efficiency of payments. And that is where digital payments come in.

Already popular across retail, media & entertainment, and hospitality industry, digital payments have had a slow growth in the insurance industry. But the sudden onset of the Pandemic has made insurers realize that the future landscape of payment preference has changed rapidly.

To keep up with this change, insurance carriers must integrate digital payments within their business & IT operations as soon as possible.

Despite this awareness, there have been some significant roadblocks to providing seamless payment processing for insurance companies. Let us examine these challenges before moving on to the discussion of how insurers can accelerate digital payment integration for better customer experience & business growth.

The Challenges Of Digital Insurance Payment Processing

The benefits of digital payments in insurance range from improving customer experience, loyalty, and customer retention rates to reducing claims payment frauds. These expansive benefits of insurance payment processing have encouraged over 67% of insurers to adopt digital payments as part of their business operations.

However, before reaping the rewards, insurers must contend with some serious digital payment challenges. Let’s discuss the top 3 digital payment challenges insurance carriers need to find the solutions to before they leverage the technology for inbound and outbound payments.

1. Rising Number of Payment Methods in The Market

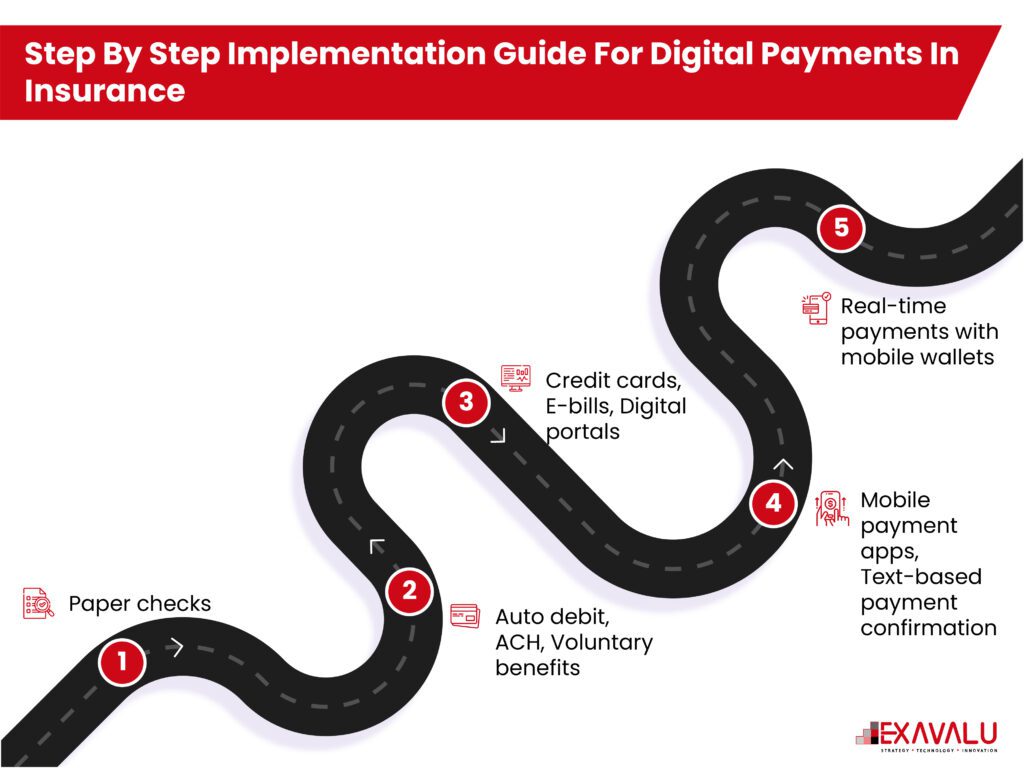

At the end of the day, digital payment is just a consolidated term for various online and touchless payment processes. Ranging from electronic payment systems such as wire transfers and eChecks to mobile payment & wallet apps, each of these payment methods has its own merits. This diversity of payment methods, however, is the first digital payments transformation challenge insurers must overcome.

In order to provide an inclusive and omnichannel experience to the wide demographic of their customers, insurers need to continuously monitor and integrate new digital payment methods within their insurance payment processing systems. However, each new payment processing method has its own requirements, and insurers need a lot of resources to integrate such different methods of payment and align their IT operations with each new payment channel. This need for continuous scalability and alignment becomes one of the big challenges in integrating digital payments.

2. IT Ecosystem Readiness To Implement Digital Payment

Over the last few years, digital payments have become synonymous with efficiency for the users, their popularity pushing the insurers to integrate them within the payment processing system for insurance. However, digital payment is not a singular feature that can bolster the entire customer experience. In fact, putting modern digital payments systems within legacy insurance IT operations might cause more problems for insurance carriers.

This challenge of IT ecosystem readiness is more prevalent among large traditional insurance providers who still entrust a big part of their business operations to complex & fragmented legacy systems. These legacy systems impose limitations and constrict efficient insurance transaction processing, nullifying the benefits of digital payments integrations. To leverage the full benefits of digital insurance payments, such legacy insurers need to digitize the entirety of their IT operations. With all the other surrounding processes modernized, digital payments will have a more positive impact on the customer & agent experience.

3. Security & Compliance

The growth of digital payments & transactions has led to an increase in online fraud that is becoming more sophisticated every day. These online frauds such as phishing, DDoS attacks, payment data theft are affecting almost every industry, including Insurance. In fact, the insurance industry is more vulnerable to cyber threats stemming from digital payments.

The chances of online payment security breaches will increase with the volume of digital transactions between insurers and customers. This, combined with the already existing legacy system-related security challenges creates a monumental obstacle for insurers who are looking to accelerate digital payments transformation. Without mitigating these challenges. It will be near impossible for insurers to integrate digital payments within the insurance value chain.

Embracing Digital Payments: What Should Insurers Do?

With over 93% of consumers considering emerging payment methods such as biometrics and contactless, digital insurance payment processing has now become an absolute necessity for insurers. The pandemic has transformed the payment behaviors of consumers and there is now a greater expectation for businesses including insurance carriers to provide flexible payment options. The demand has reached a point where customers have admitted to actively avoiding businesses that do not offer ease of electronic payment.

Besides the customer demands, the increasing need to streamline the payment processing system and eliminate claims payment fraud is pushing the insurers to make the necessary changes to their payment operations. But how are they bringing forth the changes? Let us have a look-

1. Creating Digital Eco System For Enabling Digital Payment

Insurers who have successfully completed the integration process of digital payments have done so by modernizing the rest of the business operations. For this, they had to begin by identifying opportunities and support groups, defining success parameters, and applying analytics to measure customer responses to not only improve the digital payment features but fulfill other digital requirements of the customers as well.

Without a comprehensive system in place that makes it easier to share data and make informed real-time decisions, the integration of digital insurance payment processing will not have much effect. This is why the best strategy for insurers will be to accelerate digitization for the entire system with a complete system assessment and incremental changes. With a ground-up approach such as this, insurers would be able to leverage the full benefits of digital payments in the insurance IT ecosystem.

2. Implement Security Strategies

Along with the benefits, insurers must also be aware of the security pre-requisites of digital payment integrations. As the risk of cyber-attacks, data theft, and phishing incidents increases, insurance providers must implement strong security strategies to protect policyholders from malicious online activities.

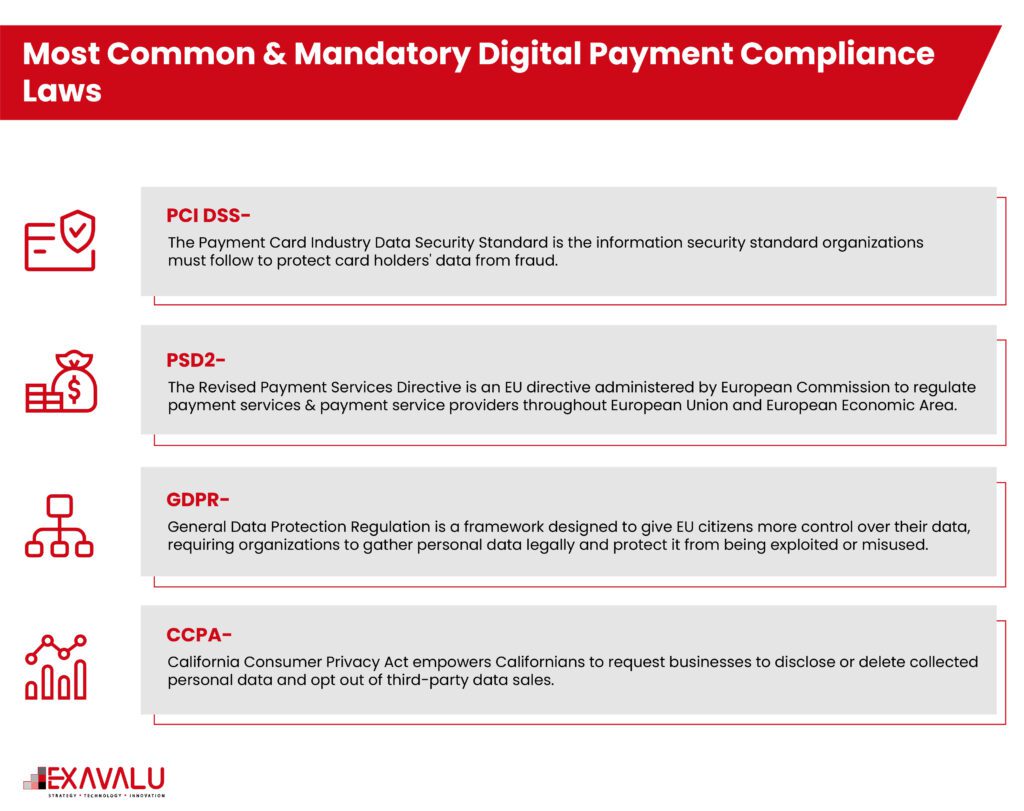

There are three different ways insurance carriers can guarantee the security of digital insurance payment processing solutions. They can begin with digital payment regulatory & compliance laws, along with the different data protection laws and regulations imposed by different countries.

At the same time, insurance providers should also follow best practices such as-

- Transaction data encryption

- Tokenization

- Strong password protection & recovery services

Additionally, to further mitigate the risk of cyber-attacks and payment frauds, insurers can utilize AI & machine learning. With these technologies, they can continuously monitor and identify suspicious payment activity. Embracing multiple ways of securing payment gateways and transactional data will result in increased policyholder trust and operational efficiency for the insurance carriers.

3. Flexibility Of Payments Catering To Customer’s Need

The flexibility of payments is important for a good customer experience. For insurers who are imbibing a digital insurance payment processing system, flexibility is necessary to cater to the requirements of a wide range of target customers.

The flexibility preference has two sides to it- the first one being the flexibility of using different payment methods, the other one being an omnichannel experience. There are multiple emerging digital payment methods in the market along with many established ones- and they all have numerous users. These user bases are made of people from different generations, and catering to their preferences is going to be important for the insurers. Even though there are some integrational and management challenges to having multiple payment channels, insurers can begin by prioritizing the payment methods based on the target audience, their age & payment preferences. This way insurers will get less overwhelmed and follow an easy track to digital insurance payment transformation.

On the other hand, we have omnichannel flexibility. Different generations of users are used to different devices. While the baby boomers are much more comfortable with phone calls with agents and receiving checks in the mail, the more modern generations of Millennials and Gen Z want self-services and a faster payment experience- leading to different channel requirements. This difference in channel preferences can also be easily managed with a complete assessment of the target demographic and their online behavior.

To offer true flexibility of payment, insurers need to ensure that the customer can make payments from any device, using any method at any time. And to augment this, a complete understanding of their customers and their needs is going to be necessary while working on digital payments transformation.

4. Leverage Technology To Eliminate Data Reconciliation Challenges

There’s already substantial pressure on the insurance reconciliation process because of the growing transactional volume. This pressure is increasing even more due to the emergence of digital payments. That’s why insurance carriers who want to integrate digital payment systems to streamline insurance payment processing must prepare for the data reconciliation challenges as well.

Without the ability to efficiently verify & validate data collected from multiple transactional systems, insurance carriers can experience delays in adjusting claims, which leads to increased claims processing costs and reduced customer satisfaction. This is why, while digitizing the payment processing system, insurers should also consider automating the data reconciliation process. Using automation to efficiently collect, verify & validate transactional data will help insurers save resources and enhance customer satisfaction.

5. Choosing The Right Payment Service Provider

Last but not least, partnering with the right digital payment service provider remains one of the crucial steps for insurers in their digital payment integration journey. With the right partner by their side, insurers can provide a secure, fast & real-time insurance payment processing experience to the policyholders and enhance in-house business operations.

When it comes to choosing a partner, insurers should search for three things- industry experience, security & transparency, and integration costs. Having a digital payment processing partner who has relevant industry experience, offers competitive integration costs with no additional fees, and ensures security & transparency of transactions is going to be important for insurers to successfully incorporate digital payments within business operations.

Case Study: How Exavalu Helped Boutique Insurance Provider Transform Claims Experience With Digital Payments

At Exavalu, we incorporate our years’ worth of experience in digital transformation with our core insurance industry knowledge to help insurers make the best of technology.

Therefore, when a boutique P&C insurance company wanted to elevate their claims customer experience with digital payment integration, they reached out to our team of experts. Read detailed case study.

A. Client Requirement for Digital Payment

The California-based P&C insurance company was facing multiple challenges with the manual insurance claim payment process, which was affecting the back-office operations, as well as customer experience adversely. Through digital claims payment integration, they wanted to-

- Achieve faster & more efficient claims processing

- Enhance the claims settlement experience for the customers

- Lower the operational costs caused by the legacy system

B. Our Response to The Client’s Requirements

Drawing on our experience & resources, we provided our clients with technical & business process expertise around Guidewire InsuranceNow integrations with One Inc, helping with requirement definition & overall integration.

Unique Features of The New Digital Claims Payment

Completed within an aggressive timeframe of 3 months, the solution covers multiple payment methods to offer flexible insurance payment processing to both our clients and their customers. Besides the flexibility of payment, here are some other unique features we integrated within the new digital payment solution-

- Payee identification

- The new system can identify the payee type when a new payment is made. This type can vary, such as insured/claimant, vendor, mortgagee, lienholder, third party carrier, etc.

- Appropriate data is gathered for association based on the payee type, along with any additional requests like expediting payment or certified payments.

- Payment request management

- Appropriate payment requests are formulated and sent to One Inc through API calls; this is done based on the payee type.

- The payment transaction with the request details is updated in InsuranceNow.

- Payment response/updates

- One Inc sends an immediate response on the status of the payment request, and the same is updated on the payment transaction.

- Any change to the payment status is reported by One Inc and it is immediately recorded in the payment transaction in InsuranceNow, reducing complexity in the reconciliation process.

Driving Higher Customer Satisfaction with Digitized Claims Payment

Completed within a short amount of time, the Guidewire InsuranceNow integration with One Inc augmented the digital claims payment operation for our client, resulting in a sharp hike in customer satisfaction levels, while creating efficiencies for claims examiners.

Conclusion

In light of recent socio-economic upheavals and changing customer expectations, digital payments seem like the perfect first step for insurers to embrace a digital-first service model. But without an organization-wide transformation strategy in place, the singular attempt of digitizing payments will not be effective enough. To ensure sustainable growth of their business model, insurers need an experienced strategy and implementation partner by their side. And that is where we come in.

Over the years, Exavalu has enabled insurers to leverage the full benefits of digital solutions to enhance insurance payment processing, customer experience, and in-house operations. With the help of our experienced leaders and expert technology teams, we can ensure that your digital transformation initiatives benefit both your insurance organization’s employees and customers.