First Notice of Loss Made Simple: Redefining Claims Management for the Digital Customers

The limited and patchy interaction along the policyholder claim journey poses many operational challenges for insurers whose goal is to enhance customer loyalty and retention while achieving operational efficiency and speed. Although efforts can be made to enhance customer experience through digital forms and call center support, the ultimate determinant of customer satisfaction lies in the end-to-end claims experience, which is often marred by a cumbersome first notice of loss process and many hand offs and follow up phone tagging between the adjuster and the claimant.

FNOL in insurance often serves as the policyholder’s first point of contact with their insurance carrier as a result of incurring a loss. This initial interaction can have a profound impact on insurance customer experience which may lead to attrition if not handled effectively, consistently and with speed.

A positive FNOL experience can foster customer loyalty, whereas a negative one can result in customer attrition and financial losses and ultimately damage the carrier’s net promoter score or JD Powers score among other effects.

Furthermore, a subpar FNOL experience can lead to inflated claims costs and reduced operational efficiency. Therefore, insurers must prioritize the improvement of the FNOL process to offer a seamless, streamlined and consistent customer experience, ultimately leading to enhanced customer experience and valuable operational efficiency gains.

However, before delving into potential solutions, it is crucial to gain a comprehensive understanding of the challenges faced by policyholders during the insurance FNOL.

First Notice of Loss challenges: What’s Troubling The Policyholders?

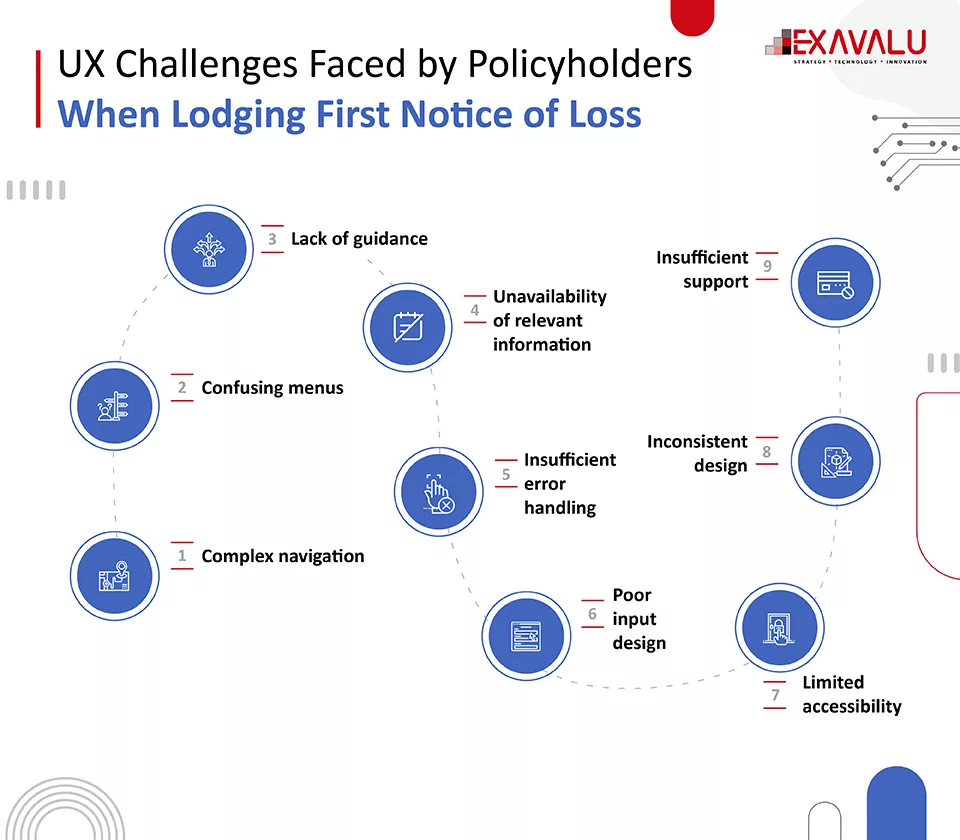

For a policyholder who has recently suffered a significant loss, the crucial elements that shape a remarkable insurance experience are ease of processing, swiftness and compassion. This is why it is important that they can effortlessly initiate the claims through an intuitive FNOL process, without any hindrances. Nonetheless, even during this procedure, the policyholder encounters a multitude of hurdles and obstacles.

A. Poor Submission Experience in Web Portals and Mobile Apps

The pivotal role of digital self-service in filing a claims FNOL cannot be overstated, as numerous policyholders prefer to personally report their losses. To streamline this procedure, insurance providers have implemented various channels, such as call centers, web portals and mobile applications, enabling customers to effortlessly submit their details and documents digitally.

Nevertheless, even these digital solutions are not immune to certain inefficiencies. Navigational complexities, apprehensions regarding the security of sensitive information uploaded online, technical glitches such as downtime and slow page loading, and the absence of mobile optimization collectively contribute to transforming what should be a seamless digital FNOL experience into a burdensome ordeal.

B. Complex Document Submission Process

The process of filing a claims FNOL involves a substantial amount of customer provided data, and currently, customers bear the burden of providing all the necessary information manually via documentation, photos and evidence information, presenting the next major challenge in the initial reporting of FNOL. Policyholders often find themselves overwhelmed with the requirement to submit numerous documents right from the start, leading to additional obstacles and delays. Ensuring that all the documents are meticulously organized and submitted correctly becomes a time-consuming and anxiety-inducing task.

Compounding the issue, many insurers lack flexibility in their digital FNOL when it comes to document submission, meaning that once an incorrect document is filed, it cannot be rectified. Consequently, when policyholders are already grappling with significant losses, the documentation stage of the FNOL process introduces an extra layer of complexity and stress, ultimately deterring them from seeking further engagement with the same insurance provider.

C. Lack of Prompt Response from The Insurers After FNOL Submission

In the realm of insurance customer experience, a prolonged delay following the initial notification of loss can wield a detrimental impact. Imagine yourself in a distressing situation, where you, as a policyholder, have placed your trust in an insurance company to provide the promised support and coverage. During such trying times, prompt communication regarding the progress of your claims request becomes imperative. However, failing to fulfill this obligation not only reflects poorly on the quality of customer service but also leads to frustration, uncertainty, and anxiety among customers. The ensuing damaging experience creates an unforgettable impression on the FNOL process flow, ensuring that when the time for policy renewal arrives, these customers will never again gravitate toward the same insurer.

D. Absence of Human Touch in The FNOL Process

Within the sphere of rapid, digital FNOL filing processes, a glaring absence becomes apparent: the invaluable presence of empathy and understanding offered by a human agent. This absence inevitably detracts from the overall quality of engagement. In moments of crisis, policyholders often require precise answers to questions related to their unique situations. Unfortunately, insurance customer experience agents and adjusters are frequently ill-equipped to provide the empathetic and meaningful assistance necessary during these times of need. The inability to offer genuine human empathy during critical moments of a digital experience can have a profound impact on customer loyalty, making it arduous for insurers to retain their valued clientele.

Unfortunately, insurance customer experience agents are frequently ill-equipped to provide the empathetic and meaningful assistance necessary during these times of need. The inability to offer genuine human empathy in critical moments can have a profound impact on customer loyalty, making it arduous for insurers to retain their valued clientele.

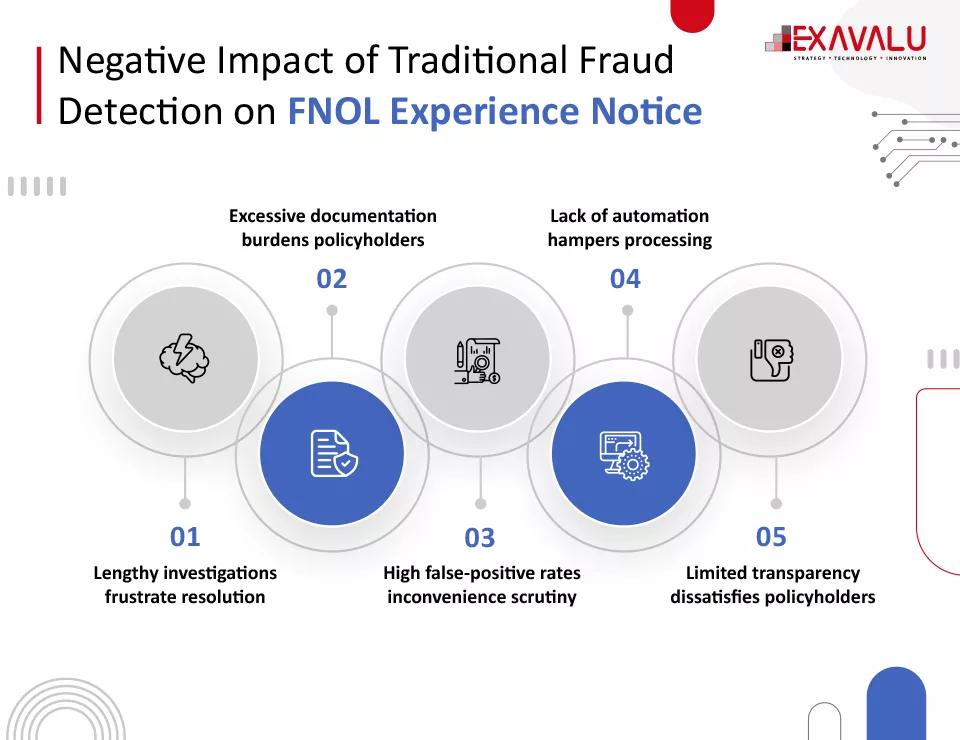

E. Manual Fraud Detection Process Resulting in Customer Inconvenience

According to the statistics, in property & casualty insurance, an astonishing sum of around $45 billion is attributed to the insidious clutches of fraud, and nearly 10% of all losses incurred in the property and casualty domain stem from deceitful claims. The archaic methods employed by insurers to combat this rampant issue only serve to exacerbate the problem, burdening the already complex process of reporting the first notice of loss (FNOL).

In their quest to fend off fraudulent claims, insurance providers often demand a plethora of additional documents and information from policyholders, subjecting even the most legitimate claims to unwarranted scrutiny. Consequently, a pall of suspicion descends upon the relationship between policyholders and insurers, casting a dark shadow over the customer experience and, inevitably, resulting in the loss of trust and valuable business opportunities.

The Solutions – Eliminating The Insurance FNOL Challenges

The challenges in improving the claims FNOL process flow are not insurmountable. Resolving the intricate issues surrounding FNOL in the insurance industry can indeed be a remarkably straightforward endeavor. By fostering a customer-centric approach and embracing suitable digital and process automation tools supplied by cutting-edge technology, insurers hold the power to eliminate these challenges. Let’s explore a few compelling avenues through which insurers can achieve this feat.

1. Improving Web Portal/Mobile App UX For Better First Notice Of Loss Experience

Insurance companies must urgently enhance the user interface of their digital web portals and mobile applications to streamline the cumbersome process of submitting a first notice of loss. This can be achieved through the implementation of intuitive design elements and captivating visual cues, coupled with explicit guidance on how to navigate the FNOL submission procedure. Furthermore, insurers must take into account the online habits of policyholders, tailoring personalized services that alleviate the anxieties and exasperations experienced by customers during challenging circumstances. By doing so, they can transform the customer experience into a more seamless and empathetic journey.

2. Streamline Data Capture & Management Process with Telematics

Enhancing the FNOL process efficiency and streamlining policyholder documentation are key imperatives for P&C insurers. To accomplish this, insurers must enhance their secure data capture, harnessing a rich array of internal and external data sources to curate comprehensive information.

Moreover, the advent of internet-connected monitoring and security devices, including smoke alarms, water sensors, thermostats, dashcams, and in-car sensors, presents a unique opportunity for insurers. By utilizing these devices, insurers can amass invaluable data that fuels the creation of predictive models and offer automated FNOL process. Consequently, this seamless integration enables precise damage assessment, prompt response times, and serves as a potent defense against fraudulent claims.

3. Improve The Response Time With Automated Communication & Chatbots

In the face of hardship, the swiftness of response holds the key to easing the overbearing weight of distress and worry carried by policyholders. Insurance providers wield a powerful tool in the form of automated messages and emails, seamlessly delivered at the very instant a first notice of loss is submitted, ensuring that customers remain informed of their claims’ progress. Moreover, the deployment of chatbots and live chat during this pivotal stage of a policyholder’s voyage provides invaluable assistance by offering automated guidance and addressing inquiries that may arise in the wake of a loss. Thus, a harmonious symphony of technology and empathy orchestrates a reassuring melody for those in need.

4. Empower Agents to Offer a More Humane Insurance FNOL Experience with Agent Facing Portal

The absence of a human touch greatly impacts the quality of the insurance customer experience. When customers find themselves in distress, it is imperative to offer them timely and appropriate human assistance. To accomplish this, insurers must ensure their agents are armed with accurate and comprehensive customer data right from the outset. Insurers can elevate the agent’s experience by implementing FNOL software solutions like an agent-facing portal that automates manual processes, provides a holistic view of customer information, and fosters enhanced collaboration across the organization. By enhancing the claims agent experience, insurers empower their agents to offer personalized guidance, improve communication, and expedite resolutions for customers, thereby significantly enhancing the overall first notice of loss process.

5. Better Fraud Prevention Techniques

Fraud prevention techniques may not directly impact the customer’s FNOL process flow, but they significantly influence the speed and efficiency with which insurers handle first notice of claims requests. Insurers need to eliminate the unnecessary complexity caused by manual fraud prevention methods and instead adopt predictive modeling and automated fraud detection systems. This enables carriers to swiftly automate the identification of potentially fraudulent claims while reducing the reliance on manual inspection.

Additionally, insurers must effectively communicate the steps taken to prevent fraud, reassuring policyholders of their protection. Clear communication during insurance FNOL process empowers policyholders, allowing them to comprehend the necessity of certain measures and what they can expect throughout the claims process.

How Exavalu can help with Improving First Notice of Loss?

The significance of a seamless first notice of loss experience cannot be overlooked when it comes to insurance success. At Exavalu, we leverage our extensive industry knowledge and technical proficiency to provide a range of inventive tools and services designed to enhance the FNOL process. Our Advisory Services and state-of-the-art digital engagement solutions, including customer and agent portals, collectively aim to elevate the FNOL journey. These groundbreaking solutions propel efficiency and customer satisfaction, revolutionizing the insurance FNOL experience to unprecedented levels of excellence.

1. Exavalu’s Exemplary Advisory Services

Our Advisory Services excel in optimizing FNOL claim process for insurance companies. With a wealth of expertise in Insurance Operations & Technology and a talented team of consultants with extensive Insurance experience, we assist clients in evaluating, recommending, and executing digital and core transformation initiatives to achieve desired business outcomes.

With a thorough assessment of existing processes, our seasoned experts provide valuable insights and recommendations to enhance efficiency, reduce costs, and elevate customer satisfaction. Our services focus on vital areas like process automation, data analytics, and seamless technology integration, resulting in a streamlined FNOL workflow. Our actionable recommendations pave the way for remarkable process optimization.

2. Exavalu’s Cutting-Edge Digital Engagement Solutions

Exavalu’s digital engagement solutions utilize cutting-edge Insurtech solutions and modern low-code and hyper automation technologies to enhance the digital FNOL experience. These solutions blend automation, advanced data analytics, and superior process optimization to improve operational efficiency and transform customer interactions.

Customer Portal: A Gateway to Excellence

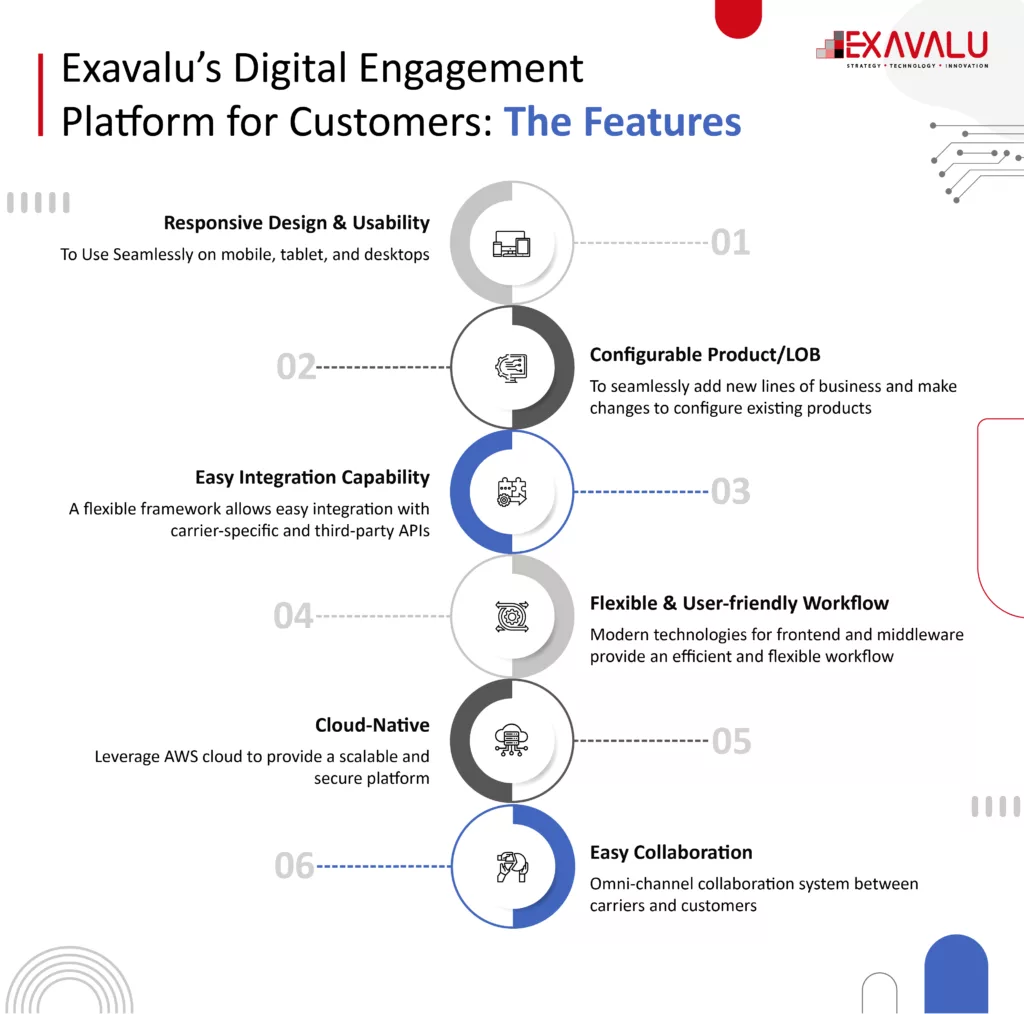

The Customer Digital Engagement Platform, designed specifically for personal insurance providers, offers a versatile, responsive, and user-friendly interface with a wide range of features that empower customers to efficiently manage their policies. Our platform ensures a smooth experience for both policyholders and insurers, allowing them to easily report claims from any device and expedite the entire process through self-service.

With its user-friendly design, customers can effortlessly provide vital information, upload relevant documents, and closely monitor the progress of their claims. The portal not only strengthens the relationship between customers and carriers and streamlines the claims reporting process, it also helps the policyholders to lodge first notice of loss in a more simplified manner.

Agent Portal: Empowering Agents with Unparalleled Expertise

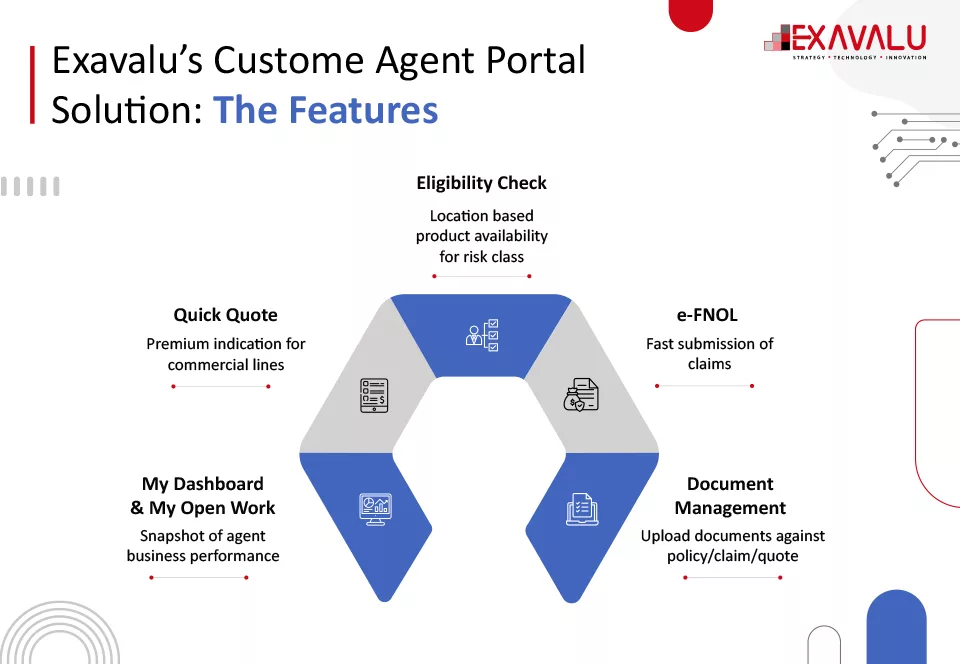

The concept of an ideal insurance agent portal extends beyond its function as a mere information repository. It strives to deliver more than just data; it aims to provide meaningful, holistic, and contextual information that agents can leverage to enhance their operations. Exavalu’s Agent Portal (watch demo video), tailored for commercial insurance carriers, places agents at the focal point of pertinent business information. With its user-friendly interface and comprehensive set of features, the portal empowers agents to efficiently manage their work processes.

By streamlining time-consuming tasks, agents can dedicate more of their valuable time to elevating the policyholder experience deliver personalized experience, especially during the FNOL process, ultimately strengthening customer satisfaction.

Revolutionizing the FNOL Process: Exavalu and Guidewire’s Strategic Partnership

Exavalu, with its deep expertise in Guidewire solutions, is poised to significantly enhance the First Notice of Loss (FNOL) process for insurance organizations. By leveraging our Exavalu-Guidewire partnership, we can streamline and optimize the FNOL process flow, enabling insurers to deliver faster and more efficient claim-handling services. Through customized configuration and integration of Guidewire’s comprehensive suite of tools, we can enhance data capture, automate claim documentation, and implement intelligent decision-making processes. This expertise empowers insurers to expedite claim registration, accurately assess damages, and facilitate prompt communication with policyholders, ultimately resulting in improved customer satisfaction, reduced cycle times, and increased operational efficiency. Our adeptness in leveraging Guidewire ensures that First Notice Of Loss becomes a seamless and impactful process for insurance companies, delivering tangible benefits across the claims management lifecycle.

Conclusion

Improving claims FNOL experience is critical to retaining customer loyalty and increasing operational efficiency for insurers. By addressing common challenges in the claims process and leveraging technology solutions and services, insurers can improve FNOL experience and reap the benefits of higher customer satisfaction and loyalty, lower claims costs, and increased operational efficiency. Exavalu is a leading provider of technology solutions and services for insurers and can help insurers achieve these goals through personalized digital FNOL processes, digital tools and automation, analytics and data-driven decision-making.